Verify the Tax-Exempt Status of Potential NonProfit Clients

GuideStar provides a wealth of information about non-profits. We definitely use it whenever we work with new charities. They instantly offer in-depth information to help us eventually make informed decisions.

About GuideStar

GuideStar specializes in reporting on US nonprofits. In fact, they were one of the very first sources of information on nonprofits. Not only do they provide in-depth information, but also verify legitimacy. In other words, they verify the organization gives donated funds to the donors they are intended for. This is especially important in times of disaster when people are most likely to donate. Straightaway they know exactly who to trust and give money to.

Recently donors have revealed their interest in wanting to know more about nonprofits. Specifically before offering up donations. In fact, many entities including donors but also funders and financial advisors want to know this type of information. Knowing basic financial information as well as the impact and effectiveness of the charity helps to educate. After all, making informed decisions gives the proper charities aid in helping people who need it.

In essence, GuideStar gives essential insights into charities. I found this recent e-mail message very helpful so I thought I would share it here. For the most part, knowing where donations go can increase the likelihood of receiving donations.

|

Guidestar can help you simplify your due diligence.

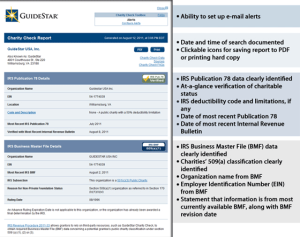

Charity Check is the only pre-grant due-diligence product that is 100% compliant with IRS requirements for qualifying recipients of grants and tax-deductible contributions.

Charity Check packages up the trusted information your clients need to make confident giving decisions.

|

|||

|

Anatomy of a GuideStar Charity Check Report

|

|||

Looking for even more valuable resources? Check out the Charity Charms blog!

0 Comments